Shabir Hussain CEO & FOUNDER, SHAM LUXURY PROPERTIES London, England, United Kingdom

Shabir has years of experience in Banking, Corporate Purchasing and Real-Estate, having held positions at BNP Paribas, Fam Properties and Birmingham City Council.

When he saw there was a Demand, he didn’t wait for the opportunity he created it and became that bridging gap between the UK and UAE to serve investors.

The GLOBAL strategist

The market today

SHAM | EDITION VISION & VALUES

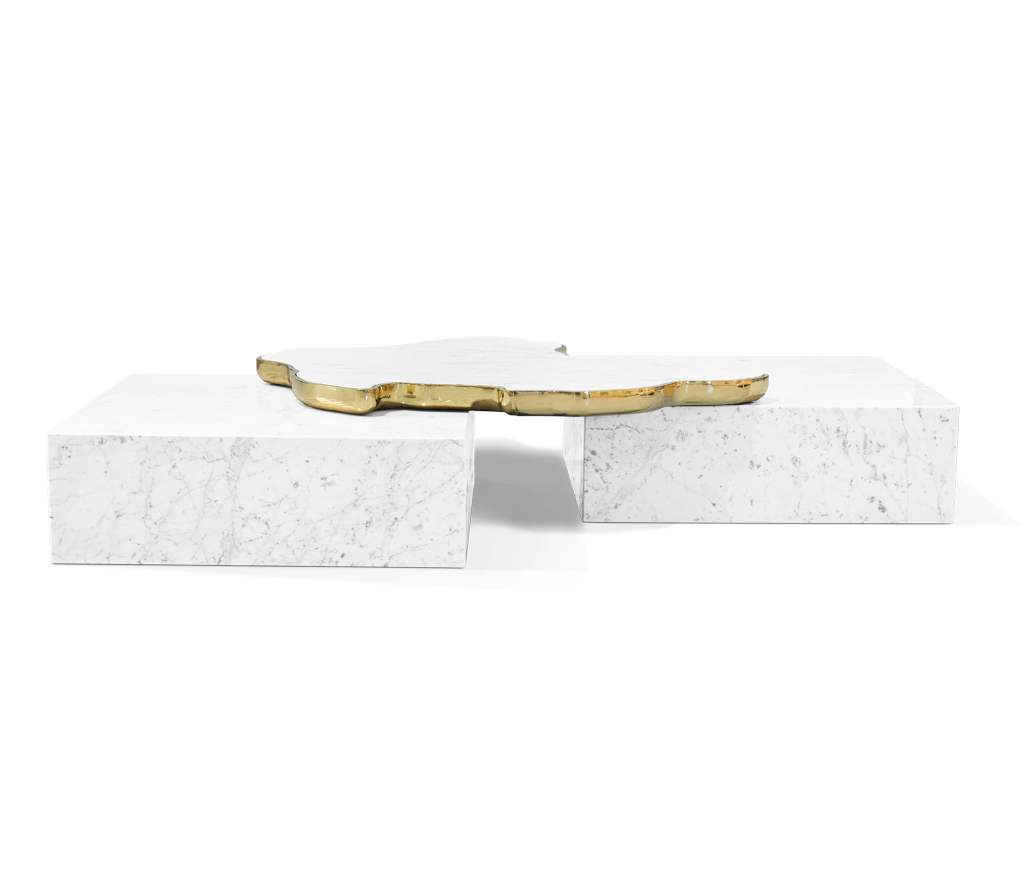

Our team has a great interest in focusing on key developing regions, that have a low supply and a high demand for property. Secondly, our focus is on London, Birmingham and Manchester as these are the top three cities with outstanding universities for the international clients to generate a lucrative return. We also provide Bespoke Residential Apartments in Dubai, built to impress with the unique designs and architecture overlooking the breath-taking views. These signature developments add value to our investor’s portfolios.

Moreover, we are that bridging gap between the buyer’s and the sellers worldwide, we make the possible happen, and facilitate the most important transaction with integrity.

Our team are highly driven and do things that other people are afraid to do, to win in the market. We have partnered up with several recognized developers in the United Kingdom and United Arab Emirates, serving clients to buy and sell the most luxurious properties with peace of mind.

FREQUENTLY ASKED QUESTIONS BY INVESTORS

Subsequently, with all the issues the world has been facing since the Global Pandemic, Investors are keen to ask questions about the condition of the market before making any decisions. The most common question I get asked is “when to invest”, well, my answer is, “there is not a Golden time to invest.

The best time to buy is in a low market, which enables you to minimize your risks, while maximising your upside potentials and most importantly to factor your exit strategy in place, this allows you to maximise your returns.

This can only be done right, if the investment advisor has made an educated decision in sourcing, reviewing and structuring the deal, in a way that will benefit your investment.

HOW RESILIENT WAS THE UK REAL ESTATE MARKET BEFORE COVID 19

As you all know the UK market is one of the strongest markets in the world, attracting thousands to invest in prime areas. In 2019 the national housing price growth come to a standstill due the lack of supply, this was a positive for landlords as the rental growth saw a slight increase during 2019 due to declining availability of homes to let. So, this just shows there was a Supply vs Demand issue that we were facing.

The private rents in London on average rose by 0.9% in nominal terms in the year to June 2019 (ONS). This is up from -0.2% in June 2018 and marks seven consecutive months of positive nominal rental growth.

DID THE PANDEMIC IMPACT THE REAL ESTATE MARKET

The whole world was on a standstill and the property prices fell sharply after the onset of COVID-19 when the ockdown measures restricted the completion of property transactions.However, they quickly recovered, reaching a new record peak by November 2020.

These increases were mainly driven by the policies introduced early on to support businesses, household incomes and the housing market. These boosts to demand interacted with the decades- long under supply of housing – exacerbated by even worse than usual construction levels in Q2 2020.

Movement restrictions introduced in the second quarter of the year followed by the gradual easing of restrictions and the subsequent introduction of a property transaction tax holiday in July 2020 (which was due to run until March 2021) have made 2020 an unusual year in the housing market.

HMRC estimates pointed towards a 14.9% yearon-year increase in UK residential property transactions over 2021-22 (1,374,050), with annual volumes reaching their highest level since 2007- 08 (1,473,950) and year-on-year growth in the post-financial crisis era surpassed only by that in 2013-14 (22.8%).

Despite transaction volumes contracting for three consecutive quarters through Q4 2021, from the record high of Q2 2021 and as a combination of temporary stimulus support being wound down and exponential growth in house prices pressured affordability for many, quarterly transaction volumes remained both above or in line with the long-term average, and above levels recorded during the lockdown nadir through near-term post-lockdown recovery period.

Shabir-hussain Ceo Sham Luxury Properties

WHAT’S HAPPENING IN THE MARKET NOW

As a result of the fall and the subsequent recovery of London rents during the pandemic, annual increases in average asking rents were at a high of 15.8% in the second quarter of 2022, with Rightmove recording the highest annual growth ever in any region.

Demand for private rental homes remains above supply in London and there are signs that both supply and demand are continuing to increase slowly, despite reports of many landlords considering leaving the market.

According to the House Price Index from the ONS, London house prices rose by 7.9% over the year to April, up from 4.9% annual growth in March. The average house price was highest in

Kensington & Chelsea at £1.5 million, and lowest in Barking & Dagenham at £336,000.