If you’ve been dreaming of becoming a homeowner, one big concern may be weighing on you: coming up with the minimum down payment for a mortgage.

The median existing-home price was $352,800 in September 2021, according to data from the National Association of Realtors, and that number seems poised to jump even higher due to a hot housing market and low inventory in many parts of the country. However, you don’t have to let the asking price scare you away from looking at mortgage rates. Depending on the type of mortgage you choose and your willingness to pay for mortgage insurance, you may be able to buy a home with a small upfront down payment.

Let’s take a look at how much you really need in order to stop renting and start building equity in a home.

What is the minimum down payment for a house?

A down payment is the amount of money you contribute towards the purchase of a home. Think of it as the amount you initially put up as your share of ownership. The higher your down payment, the less you’re asking to borrow — and the lower your monthly payments will be.

Lenders require a down payment for most types of home loans, but there are exceptions for certain types of buyers. Here are the basic down payment requirements for various types of mortgages:

| Loan type |

Minimum down payment |

| Conventional loan |

3%-15% depending on lender and loan |

| Jumbo loan |

20% or more depending on lender |

| FHA loan |

3.5% |

| VA loan |

None required |

| USDA loan |

None required |

Conventional loans follow guidelines set by Fannie Mae and Freddie Mac, but lenders can have their own requirements above those standards, as well. There are conventional loan options that require a down payment of as little as 3 percent, but many lenders impose a 5 percent minimum. If the loan is for a vacation home or a multifamily property, you could be required to put down more, generally 10 percent and 15 percent, respectively.

Jumbo loans, which exceed the loan limits set by Fannie Mae and Freddie Mac, tend to require a higher down payment than other kinds of mortgages. These are larger sums, hence the “jumbo” name. The minimum is usually determined by the individual lender, but it can be 20 percent, 25 percent, 30 percent or more.

FHA loans, backed by the Federal Housing Administration, are available for as little as 3.5 percent down if the borrower has a credit score of at least 580. If the borrower has a lower score (500-579), the minimum down payment is 10 percent. FHA loans have other costs, though, including an upfront mortgage insurance premium and mortgage insurance throughout the life of the loan. One option to note: If you have a low credit score today, you can consider taking out an FHA loan and refinancing into a conventional loan when your credit improves down the road.

VA loans, which are available to active-duty military, veterans and eligible surviving spouses don’t require a down payment. USDA loans also don’t require a down payment, but the borrower needs to be buying in a designated rural location to qualify. There are other fees to consider with these government-backed loans, including a VA funding fee and an upfront fee of 1 percent of the loan amount with USDA-backed mortgages.

Average down payment for a house

Now that you have an understanding of the minimum amount for a down payment, you might be thinking about another question: How much is the average down payment for a house? The most recent data from the National Association of Realtors shows that the average homebuyer makes a down payment of 12 percent. However, to get a closer look at typical down payments, consider what different types of buyers can afford.

First-time homebuyers: 75 percent of first-time homebuyers do not put down 20 percent. In fact, the average first-time homebuyer puts down just 6 percent of the purchase price.

Current homeowners: For those who aren’t new to buying a home, the average down payment is higher: 16 percent of the purchase price.

Cash buyers: Some new homeowners with deep pockets don’t bother putting down a fraction of the purchase price. Instead, they pay for the entire property with an all-cash offer. In September 2021, the National Association of Realtors reported that 23 percent of all home purchases were cash sales.

Debunking the 20 percent down payment myth

You may have heard that 20 percent is the required minimum, but that’s not the case. Twenty percent is simply how much you need in order to avoid having to pay extra for mortgage insurance. The insurance is to protect the lender — since you’re borrowing more money with less down, you pose a bigger risk.

The reality is that as home prices continue to rise, many homebuyers can’t afford to put down 20 percent. In fact, 49 percent of all buyers put down less than 20 percent, according to the most recent data from the National Association of Realtors.

If so many are buying homes with smaller down payments, where did the 20 percent down payment myth come from? It’s most likely based on Fannie Mae and Freddie Mac guidelines. To qualify for a guarantee from either of these entities, a borrower needs to either put 20 percent down or pay mortgage insurance.

Is it worth putting down 20 percent?

So, you don’t have to put down 20 percent, but should you? That answer depends on a number of factors, but the most important is your own bank account. If you are sitting on plenty of cash and putting down 20 percent won’t stress your finances, it’s a good move to avoid costly mortgage insurance payments. However, if a 20 percent down payment will drain most of your bank account, you’ll want to think twice. Homeownership comes with loads of other expenses, and you need to be prepared for potential emergencies, too. If that means paying mortgage insurance for a while, that’s okay.

Consider some of the pros and cons about hitting the 20 percent threshold:

Down payment less than 20 percent

Pros

- Stop renting sooner

- Start building home equity now

- Maintain more cash in your reserves

- No mortgage insurance requirement

- Lower borrowing amount means lower interest total over the life of the loan

- Potential for lower monthly payments

- Will qualify for better interest rates

Cons

- Mortgage insurance payments

- Potentially higher interest rates

- Will not be able to buy a more expensive property

- Larger loan balance means more interest over the life of the loan Cons

- May drain a large chunk of your savings

- May need more time to save enough to hit the magic 20 percent marker, which means delaying ownership

Down payment 20 percent or more

Pros

- No mortgage insurance requirement

- Lower borrowing amount means lower interest total over the life of the loan

- Potential for lower monthly payments

- Will qualify for better interest rates

Cons

- May drain a large chunk of your savings

- May need more time to save enough to hit the magic 20 percent marker, which means delaying ownership

What does a 20 percent down payment look like?

If you’re trying to determine what a 20 percent down payment will mean for your finances, the answer depends on where you’re looking to buy. Home values vary across the country, which means that saving up 20 percent of the purchase price in one city will be a lot easier (or harder) than in another area of the country. Consider the differences among these three markets, based on homes values in the middle of 2021:

Cedar Rapids, Iowa

- Median home value: $188,400

- 20 percent down payment: $37,680

Phoenix, Arizona

- Median home value: $408,700

- 20 percent down payment: $81,740

San Francisco, California

- Median home value: $1,385,000

- 20 percent down payment: $277,000

How much should you put down on a house?

It’s important to understand how much the down payment for a house will impact your payments. Consider a $300,000 home and a 30-year fixed mortgage with a 3.2 percent interest rate with different down payments:

| Home price |

Down payment |

Amount borrowed |

Monthly mortgage payment (principal and interest) |

| $300,000 |

5% ($15,000) |

$285,000 |

$1,232 |

| $300,000 |

20% ($60,000) |

$240,000 |

$1,037 |

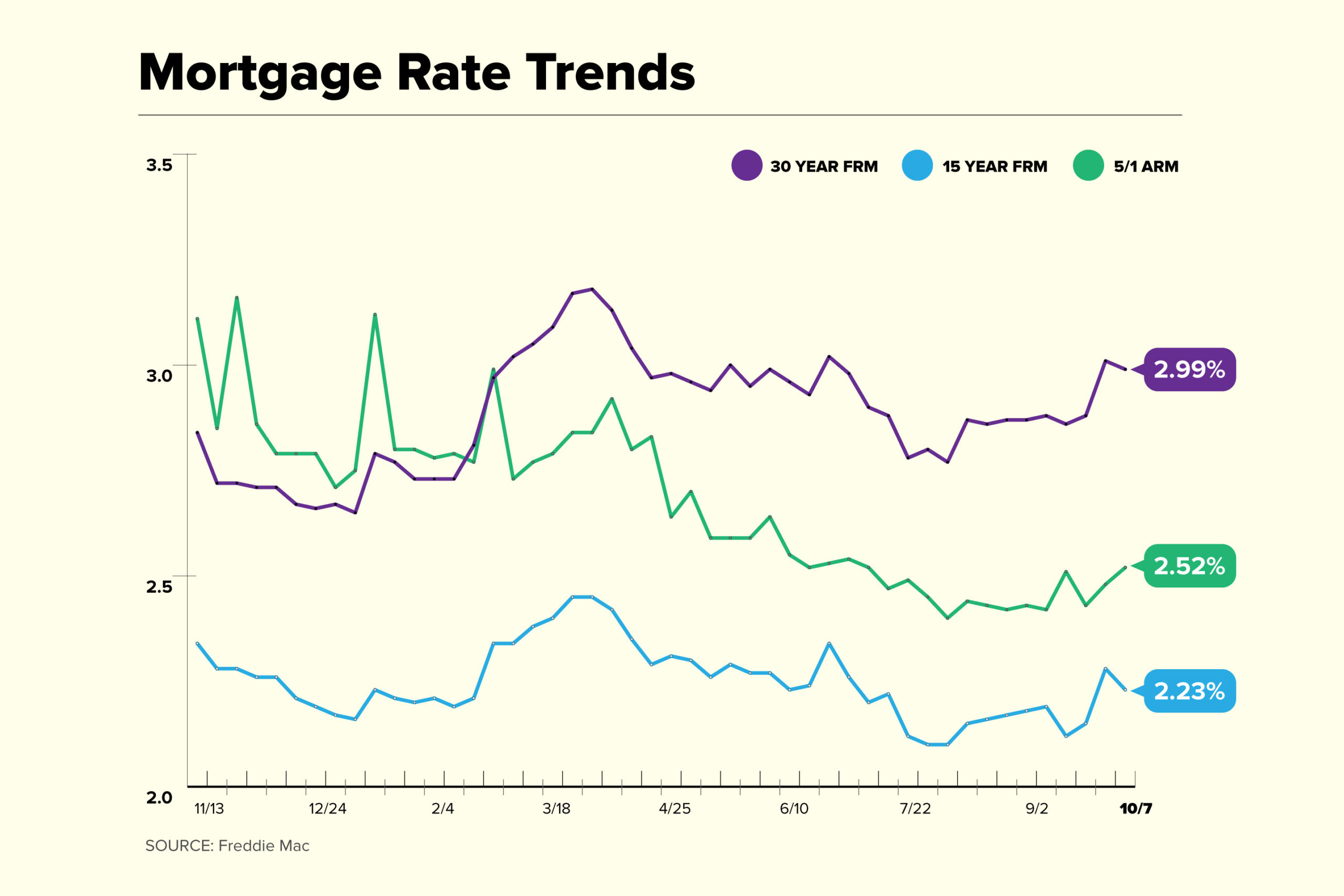

The monthly mortgage payment above doesn’t include homeowners insurance, property taxes, and, for the 5 percent down payment scenario, mortgage insurance. That cost will vary, but consider an estimate from Freddie Mac that pegs monthly premiums for the above loan at $274. Making a 20 percent down payment means you won’t have to pay this added cost.

There’s another way to look at things, though. The premiums you have to pay on private mortgage insurance for a conventional loan are cancelled once you build 80 percent equity in the property. So, dealing with that extra cost temporarily can mean the difference between continuing to rent and buying your own place. Paying an extra fee is never fun, but it helps get you in a home of your own much faster.

Another important consideration: A higher down payment can get you a lower interest rate, further saving you money each month. We didn’t account for that in the example here, but it’s one more reason why a larger down payment can be beneficial.

As you think about how much to put down on your house, consider these key factors before settling on an amount:

- Your emergency savings fund. If a crisis hits the week after you close on your home — say losing your job or receiving an expensive medical bill — will you have enough liquid savings to weather the storm? Additionally, you may have other emergencies related to the home. What if you buy it this fall and the furnace goes out this winter? Can you afford to repair it?

- Your other monthly bills. What else are you paying for each month? Your car loan, phone service, groceries — none of these will disappear after you buy a home. Compare different down payments to get a sense of how it will impact your monthly mortgage bill and budget appropriately to make sure your income can continue to cover all of the essentials along with it. As a general rule, your monthly housing expenses should be 28 percent or less of your monthly income. For example, if you make $4,000 each month after taxes, you should aim to pay no more than $1,120 for your housing costs.

- Your closing costs. In addition to a down payment, you’re going to need to cover closing costs, a range of fees associated with your mortgage that typically total 2 percent to 4 percent of your loan principal. Make sure that you have these funds set aside before determining your down payment.

You can use Bankrate’s down payment calculator to understand how different amounts will impact your bottom line. If you can afford a bigger down payment, remember not to stretch yourself too thin. You want to be able to enjoy living in that new house without depleting your entire savings and stressing about your finances.

How to save for a down payment

Regardless of what percentage you’re aiming to hit – 3 percent of the purchase price or 20 percent – you’ll need to put a plan in place to set aside that money. Here are some tips to focus on building up your down payment funds:

- Start immediately. Even if you’re still comparing mortgage offers and determining how much you really need, earmark savings specifically for your new home as soon as possible.

- Identify what to cut. Analyze your bank statements from the past few months to get a sense of where you can reduce spending and accelerate your savings. What can you cut? Can you eliminate some of your entertainment services?

- Open a separate savings account. Keeping your down payment money with your other savings could tempt you to spend it elsewhere, so consider opening a separate account specifically for your home purchase. If you can, set up regular automatic deposits from your paycheck to your savings account so you’re more likely to stick to your savings plan.

- Make a timeline. Once you know how much you need, look at how much you’ve already saved, and determine a timeline for when you want to achieve your savings goal. For example, if you want to save $20,000 in five years, you’ll need to save $4,000 per year, or $333 a month. You can also work the other way around and determine how much you can save each month by looking at your budget, and using that information as your timeline. Be sure to remember that home prices will be different in the future, too. They’ve been rising at a record pace recently. So, 10 percent of the median home price today may not hit that mark in three years.

- Research assistance programs. You might be able to save less or buy a home sooner if you qualify for down payment assistance. The federal government and local and state governments, as well as nonprofit organizations, offer these types of programs to help make homeownership more affordable. They tend to be directed toward moderate- to low-income buyers who are purchasing their first home, but there are some options for repeat buyers, as well. Some even help public service workers, such as firefighters and teachers, buy a home in the communities they serve.

Down payment FAQs

Still searching for the right answers to decide how much to save for a down payment? These frequently asked questions can point you in the right direction.

How can I avoid PMI without putting 20 percent down?

No one wants to pay extra for mortgage insurance. If you’re putting down less than 20 percent on a conventional loan, there are a couple of options. The first is lender-paid mortgage insurance, which – as it sounds – puts the lender in charge of covering those mortgage insurance premiums. However, you will still pay in the form of a higher interest rate. You’ll need to calculate what’s better for your budget: paying the PMI yourself or finding an LPMI option.

The second option for avoiding PMI is an 80/10/10 loan, which is commonly called a piggyback loan. In this situation, you can put down 10 percent and take out two mortgages. One will cover 80 percent of the purchase price, and the other covers 10 percent. You’ll never see a line item for PMI, but you will be paying back two mortgages with two sets of interest charges. You’ll also pay two sets of closing costs to cover both loans.

What’s more important: Your down payment or mortgage payment?

You might be wondering what matters more – your upfront payment or your monthly financial obligation on a home. The reality is that they are both important, and one impacts the other. The more you can put down, the smaller your monthly payments will be. However, making a small down payment isn’t necessarily a bad move. While you’ll need to spend time saving up for that big down payment, that’s a one-time cost. Your mortgage payments are going to happen every month – perhaps for the next 30 years. So, do the math to make sure you can afford that recurring bill while paying other bills and saving for the future.

Can I use a gift for a down payment?

If you can’t come up with all the money for a down payment on your own, but you have a really great person in your life who wants to help you out, you’re in luck: You can accept a financial present from someone else. However, who can give that money to you depends on the type of loan. For conventional loans, it will need to be a family member. For FHA loans, there is a bit more flexibility to use gift funds from friends, labor unions and even employers. Regardless of your loan, getting a gift isn’t as simple as cashing a check. Be sure to read the rules for using gift funds for your down payment before receiving any money.

Can a lender or seller contribute to the down payment?

One party that cannot be part of a “gift” for a down payment is the seller. They qualify as a person with a vested interest in selling the house, which excludes them from being able to write you a check. They can, however, make concessions or offer credits (typically limited to a fraction of the sales price) at closing in designated amounts to cover specific items such as repairs on the property.

Lenders can play a role in helping certain borrowers – often those who qualify as low- to moderate-income – get to the finish line via down payment grant programs and lender credits that help offset closing costs. Not every lender offers down payment assistance options, so you’ll want to ask about availability as you compare loan programs.

How does down payment affect LTV?

You’ll see a lot of acronyms when you’re trying to buy a house, and one of the most important is LTV, which stands for loan-to-value ratio. Your down payment sets your initial LTV. For example, let’s say you’re planning to put $20,000 down on a house that has an appraised value of $200,000. In this case, your LTV would be 90 percent. You’re borrowing $180,000 – 90 percent of the home’s total value. As you make monthly payments and build equity, your loan-to-value ratio will change. Once your LTV hits 80 percent, it means you have 20 percent equity and the ability to cancel private mortgage insurance on a conventional loan.

Bottom line

Don’t let the 20 percent down payment myth prevent you from becoming a homeowner. Although some loans may charge higher interest rates if you put down less than 20 percent, and you may need to pay mortgage insurance, that extra cost can be worth it to get you on your way to building equity in your own home.

Written by David McMillin