- El proyecto de restauración de Land Rover destaca la salud mental y el bienestar

- Vehículo y equipo invitados por el prestigioso club londinense

- Voluntarios trabajan para restaurar el antiguo vehículo de las Islas Malvinas desde enero

- En exposición en la Rotonda del 19 al 26 de septiembre

- Proyecto respaldado por una amplia gama de organizaciones, incluidas Britpart UK, Luzzo Bespoke, Heritage Skills Academy, Howden Insurance, Michelin UK y Bicester Heritage.

- Para más detalles contacte con Adam Gompertz

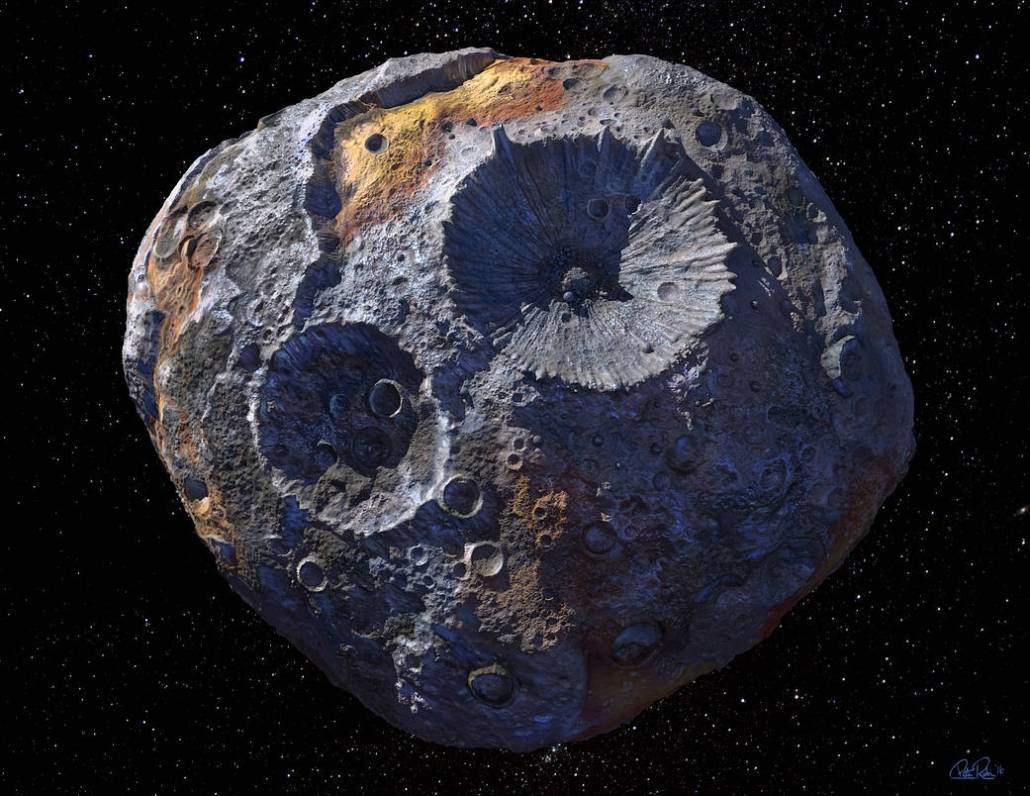

El martes 19 de septiembre se exhibirá el REVS Restore Land Rover en la famosa rotonda del distinguido Royal Automobile Club en Pall Mall. La Comunidad REVS destaca el valor de los proyectos que tienen como objetivo crear conciencia sobre cuestiones relacionadas con la salud y el bienestar mental, al mismo tiempo que celebra las habilidades de un grupo de voluntarios que han estado trabajando en el Land Rover de 1975 desde enero de este año.

El proyecto REVS Restore fue diseñado para permitir a las personas experimentar cierta restauración de su propia salud mental mientras trabajaban juntas para devolver el Land Rover a un estado presentable y manejable. Durante un fin de semana al mes, el equipo de voluntarios ha estado trabajando en el taller de Heritage Skills Academy con sede en Bicester Heritage.

Estos voluntarios estaban compuestos por personas de diferentes edades, algunos con poca experiencia trabajando en un vehículo y que nunca habían asumido un proyecto de este tipo con un vehículo que llevaba más de 10 años fuera de circulación. Han aprendido nuevas habilidades, han encontrado nueva confianza y han valorado el sentido de comunidad y el propósito que ha fomentado ser parte del grupo.

Gracias a la generosidad y el apoyo de organizaciones como Britpart UK, Luzzo Bespoke, Heritage Skills Academy, Michelin UK, Bicester Heritage, Howden Insurance y Autosparks, así como a donaciones de particulares, el proyecto ha podido avanzar a un ritmo rápido. En julio, el motor estaba en marcha por primera vez en años y, a principios de septiembre, el vehículo estaba siendo probado en las instalaciones de Bicester.

El vehículo pasó la primera parte de su vida en las Islas Malvinas como bombero de la Royal Navy y regresó al Reino Unido en 1999. El último propietario, Tim Compson, donó el vehículo al reverendo Adam Gompertz, quien dirige REVS Community CIC, un organización sin fines de lucro que busca trabajar para promover el bienestar mental y espiritual en la comunidad más amplia de entusiastas de los automóviles.

La asociación con el Royal Automobile Club se remonta a 2021, cuando el reverendo Gompertz recibió el título de Personalidad del año del club, y la relación ha crecido desde entonces, y ambas partes desean promover cómo la comunidad automovilística puede ser un lugar positivo para quienes Aman los autos, pero pueden tener problemas con los desafíos de su salud mental.

El reverendo Gompertz dijo: “Este es verdaderamente un privilegio increíble para nosotros; Poder exhibir el Land Rover en este lugar histórico y prestigioso, y con el apoyo de tanta gente, demuestra cómo la comunidad automovilística quiere comprometerse con un tema tan importante. Gracias al Royal Automobile Club tenemos una ubicación realmente fantástica para poner la salud mental en primer plano en la mente de tanta gente. Nuestro agradecimiento a ellos por esta oportunidad. De hecho, hay tanta gente a quien agradecer; Realmente ha sido todo un viaje”.

Jeremy Vaughan, director de automovilismo del Royal Automobile Club, afirmó: “Es un placer apoyar un proyecto tan valioso y ver el Land Rover en el Club lo hace aún más especial. Hemos disfrutado mucho de nuestra relación con el reverendo Adam Gompertz desde que le otorgamos el premio a la Personalidad del año en nuestros Premios Históricos 2021. Seguiremos de cerca el proyecto y esperamos ver el producto terminado”.

Acerca de REVS

La REVS Community CIC, una empresa de interés comunitario sin fines de lucro, está dirigida por el Reverendo Adam Gompertz, Ministro Pionero y Capellán de Bicester Motion.

Comenzando en 2014 como una pequeña exhibición de autos comunitaria y ahora una comunidad en línea de más de 8300 miembros, los eventos de REVS en las redes sociales han demostrado ser increíblemente populares. Impulsado por el compromiso de sus contribuyentes, el proyecto no comercial ha establecido una vibrante comunidad en línea únicamente para apoyar a otros.

El CIC se estableció en 2022 para promover el bienestar espiritual y mental positivo dentro de la comunidad automovilística en general. También es la organización detrás de la galardonada comunidad de redes sociales REVS Limiter que comenzó durante el bloqueo de COVID y ahora cuenta con más de 8000 miembros en Facebook.

REVS ha llegado a miles de entusiastas del automovilismo en todo el mundo y ha sido reconocido por los premios Historic Motoring Awards, Classic & Sports Car Club Awards, Guild of Motoring Writers Awards y Royal Automobile Club Historic Awards.