Current mortgage rates moved lower this week with the average rate on a 30-year fixed-rate mortgage settling in at 2.99%, according to Freddie Mac. The average rate for a 15-year fixed-rate mortgage moved down to 2.23%, while the rate for 5/1 adjustable-rate mortgage increased to 2.52%.

Mortgage rates slipped back under 3% this week after decreasing by just 0.02 percentage points from last week. However, rates remain above the 2.86%-2.88% range that had dominated in August and September.

Mortgage interest rates for the week of October 7, 2021

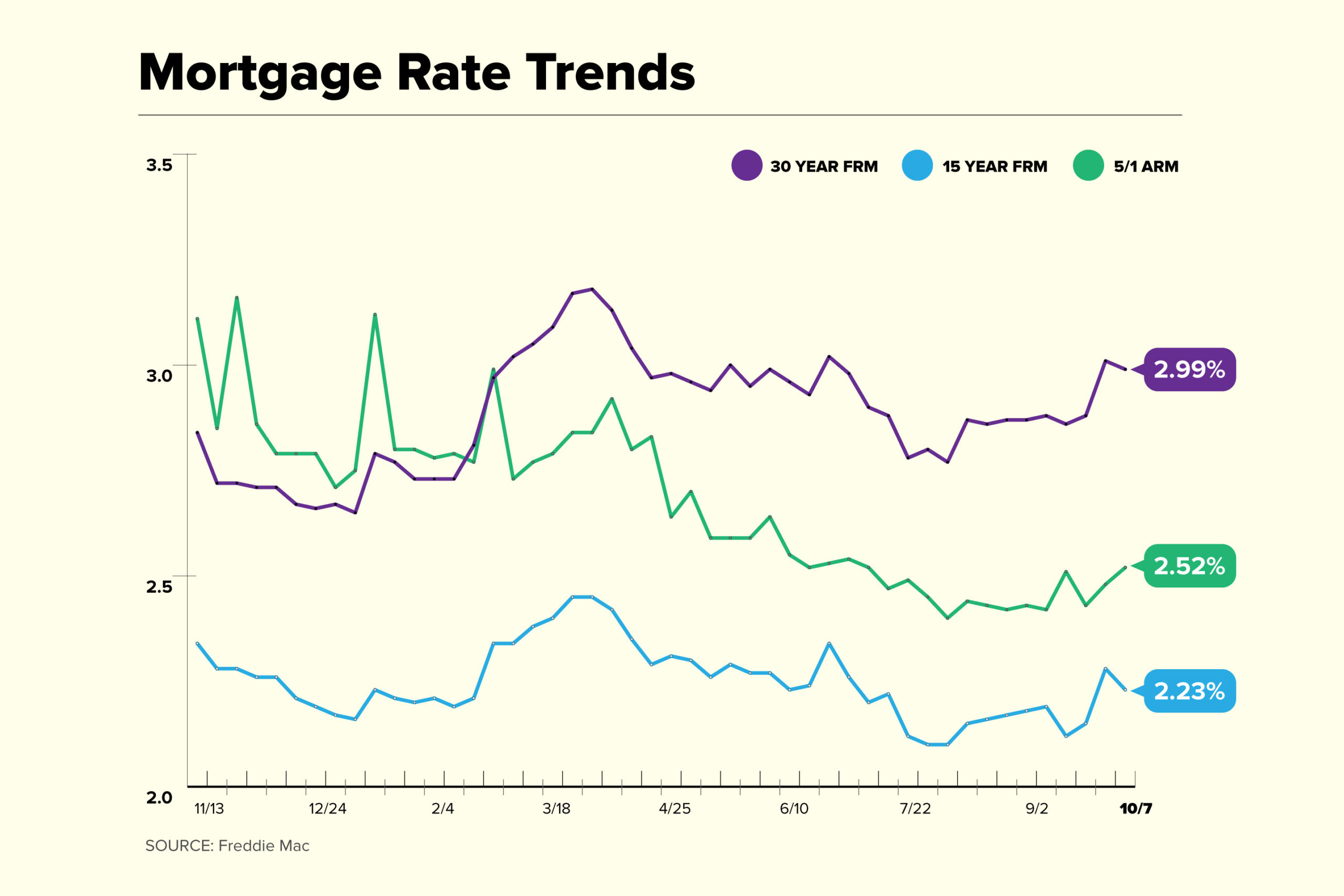

Mortgage rate trends

The average rate for most types of loans trended lower this week:

- The current rate for a 30-year fixed-rate mortgage is 2.99% with 0.7 points paid, down 0.02 percentage points week-over-week. Last year, the interest rate averaged 2.87%The interest rate during the same week last year was 2.88%.

- The current rate for a 15-year fixed-rate mortgage is 2.23% with 0.7 points paid, 0.05 percentage points lower than a week ago. A year ago, the 15-year rate was 2.37%.

- The current rate on a 5/1 adjustable-rate mortgage is 2.52% with 0.3 points paid, up 0.04 percentage points from the previous week. A year ago, the 5/1 ARM rate was 2.89%.

“Mortgage rates continue to hover around three percent again this week due to rising economic and financial market uncertainties,” said Sam Khater, chief economist at Freddie Mac. “Unfortunately, with the expectation that both mortgage rates and home prices will continue to rise, competition remains high and housing affordability is declining.”

With home prices still near record highs, homebuyers are paying an average of $50 more on their mortgage payments over the last six weeks than earlier this year, according to a report from real estate brokerage Redfin.

Today’s mortgage rates and your monthly payment

The rate on your mortgage makes a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment — $50,000 — you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments (not including taxes, insurance, or HOA fees)

- At 4% interest rate = $955 in monthly payments (not including taxes, insurance, or HOA fees)

- At 6% interest rate = $1,199 in monthly payments (not including taxes, insurance, or HOA fees)

- At 8% interest rate = $1,468 in monthly payments (not including taxes, insurance, or HOA fees)

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay.

Other factors that determine how much you’ll pay each month include:

- Loan Term: Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

- Fixed vs. ARM: The mortgage rates on adjustable-rate mortgages reset regularly (after an introductory period) and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

- Taxes, HOA Fees, Insurance: Homeowners insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

- Mortgage Insurance: Mortgage insurance costs up to 1% of your home loan’s value per year. Borrowers with conventional loans can avoid private mortgage insurance by making a 20% down payment or reaching 20% home equity. FHA borrowers pay a mortgage insurance premium throughout the life of the loan.

- Closing Costs: Some buyers finance their new home’s closing costs into the loan, which adds to the debt and increases monthly payments. Closing costs generally run between 2% and 5% and the sale prices.

The latest information on current mortgage rates

Will current mortgage rates last?

Mortgage rates saw very little movement this week compared to last week, as the 30-year rate decreased by just 0.02 percentage points to 2.99%. Last week, the average rate jumped 0.13 percentage points to 3.01%. It was the first time rates crossed above 3% since June.

Despite today’s decline, there may be more upward pressure on rates over the coming weeks. COVID-19 infections are slowing down and consumer spending was higher than expected in August. If the September jobs report due out on Friday is strong, the Federal Reserve may start tightening monetary policy sooner rather than later, leading to higher rates.

For now, expect mortgage rates to stay relatively low with the strong possibility of increases over the coming weeks unless there is negative news on the economic front.

On Thursday, the yield on the 10-year Treasury note opened at 1.531%. There tends to be a spread of about 1.8 percentage points between the 10-year Treasury and average mortgage rates. This suggests rates could go higher.

How are mortgage rates impacting home sales?

The overall number of mortgage applications decreased by 6.9% for the week ending October 1, according to the Mortgage Bankers Association. The biggest drop occurred in the refinance loan category, which decreased by double digits week-over-week.

- Purchase applications were down by 2% from the previous week and 13% less than the same week last year.

- The number of refinance loan applications was down by 10% from the previous week and 16% lower year-over-year. Despite the drop, refinances are still making up most of the mortgage loan activity, representing almost 65% of all loan activity.

“Higher rates are reducing borrowers’ incentive to refinance, as declines were seen across all loan types,” said Joel Kan, MBA’s Associate vice president of economic and industry forecasting. “Purchase activity also fell, driven by a drop in conventional loan applications.”

Current Mortgage Rates Guide

What is a good interest rate on a mortgage?

Today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower credit score or are taking out a non-conforming (or jumbo) mortgage, you may see a higher rate. A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details (such as the length of the loan, whether the rate is fixed or adjustable and other fees) fit your needs.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example —

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 (not including property taxes and insurance). You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest — a savings of over $60,000.

You can use a mortgage calculator to determine how different mortgage rates and down payments will affect your monthly payment. Consider steps for improving your credit score in order to qualify for a better rate.

How are mortgage rates set?

Lenders use a number of factors to set prevailing rates each day. Every lender’s formula will be a little different but will take into account things like the current Federal Funds rate (a short-term rate set by the Federal Reserve), competitor rates and even how much staff they have available to underwrite loans.

In general, rates track the yields on the 10-year Treasury notes. Average mortgage rates are usually about 1.8 percentage points higher than the yield on the 10-year note. Yields matter because lenders don’t keep the mortgage they originate on their books for long. Instead, in order to free up money to keep originating more loans, lenders sell their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are called mortgage-backed securities and sold to investors. Investors will only buy if they can earn a bit more than they can on the government notes.

Why is my mortgage rate higher than average?

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types (fixed or adjustable), down payment size, home location and the loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Should you refinance your mortgage when interest rates drop?

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings. You also have to consider whether your credit score would qualify you for today’s best refinance rates.

Many online lenders can give you free rate quotes to help you decide whether the money you’d save in interest charges justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could enhance interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments may be higher, but you could save in interest charges over time and you’d pay off your house sooner.

Should you buy mortgage points?

Many lenders sell mortgage points (also known as discount points). Buying points means you’d pay more up front to lower your mortgage rate which could save you money long-term. A mortgage discount point normally costs 1% of your loan amount and could shave 0.25 percentage points off your interest rate. (So, with a $200,000 mortgage loan, a point would cost $2,000.) Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points If a larger down payment could help you avoid paying PMI premiums, for example.

How to shop for the best mortgage rate

Shopping around for the best mortgage rate can not only help you qualify for a lower rate and but also save money. Borrowers who get a rate quote from one additional lender are able to save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five additional quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the loan option you need. Not all lenders write USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

Summary of current mortgage rates

Current mortgage rates are lower today, with the 30-year mortgage rate dropping 0.02 percentage points from last week. The 15-year rate also moved lower.

- The current rate for a 30-year fixed-rate mortgage is 2.99% with 0.7 points paid, down 0.02 percentage points week-over-week. Last year, the interest rate averaged 2.87%The interest rate during the same week last year was 2.88%.

- The current rate for a 15-year fixed-rate mortgage is 2.23% with 0.7 points paid, 0.05 percentage points lower than a week ago. A year ago, the 15-year rate was 2.37%.

- The current rate on a 5/1 adjustable-rate mortgage is 2.52% with 0.3 points paid, up 0.04 percentage points from the previous week. A year ago, the 5/1 ARM rate was 2.89%.