Spain is the seventh European power in soft power and the twelfth in the world according to Brand Finance

- Spain increased 1.8 points in the general ranking although it fell one position, from 11th to 12th.

- Tourism is the main driver of soft power in Spain at an international level.

- The nation is among the top 10 positions in the pillars “Culture and Heritage” (position 4), “People and Values” (position 7) and “Media and Communication” (Position 10). It is also the tenth country in the Familiarity ranking.

- Russia has lost the soft power war with Ukraine. His Reputation has plummeted globally after his conflict with Ukraine, which has caused him to drop out of the top 10 in the ranking.

- Ukraine has seen the biggest draw power improvement this year among the 121 national brands in the ranking, driven by a sharp increase in familiarity and influence.

- China retains its “Future Growth Potential”, despite being surpassed by Japan in the top 5, due to its reduced ability to reach international audiences due to COVID-19 restrictions.

- The United Arab Emirates enters the top 10 as the first national brand in the Middle East, after the success of EXPO 2020 and in anticipation of COP 28.

Access the full Global Soft Power Index 2023 report here

Access the agenda and the online event here

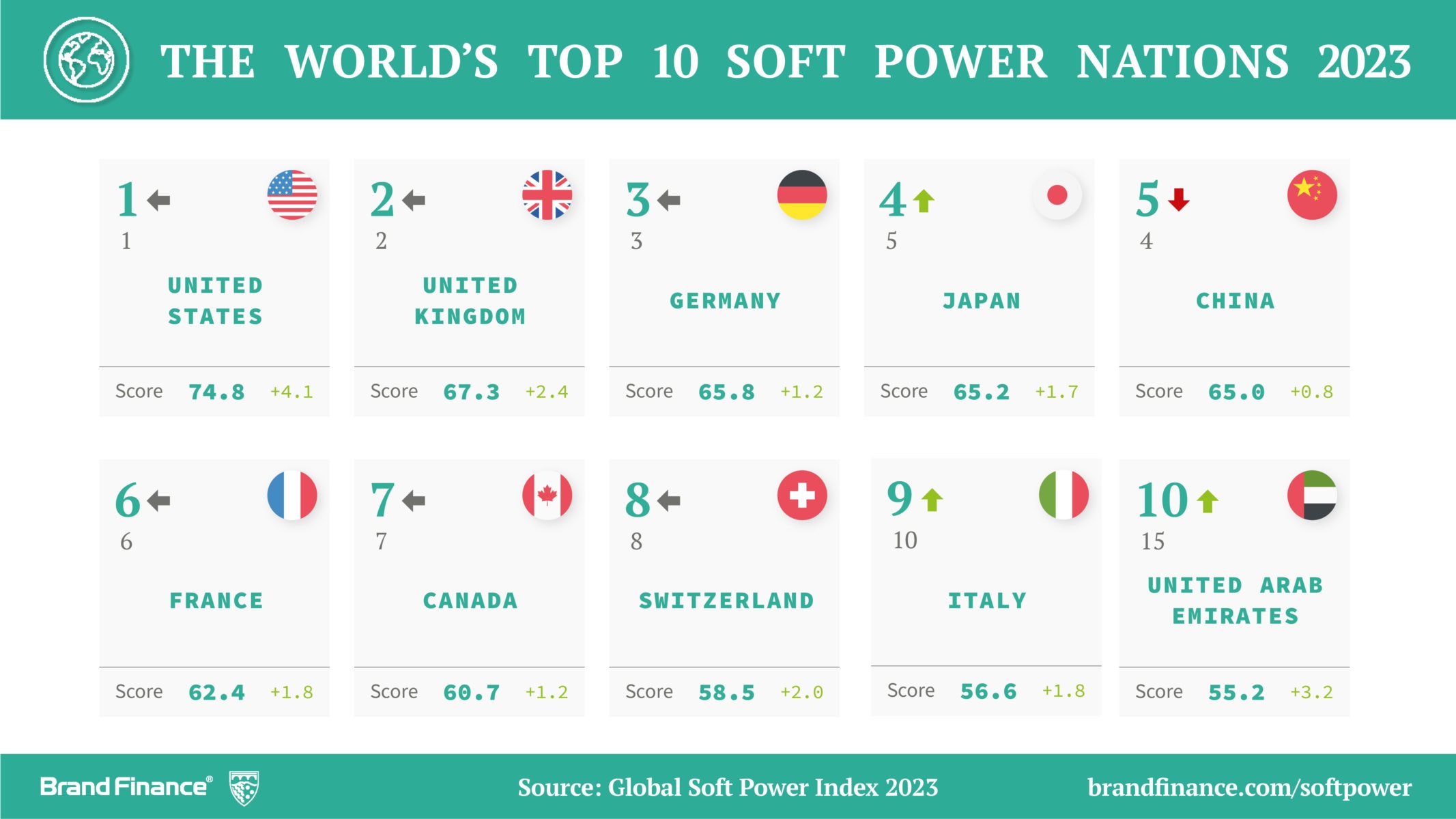

In Madrid, on March 2, 2023.- Spain is the seventh European country in the ranking of soft power -soft power- at an international level and the twelfth power worldwide according to Brand Finance, a leading brand valuation consultancy. The Soft Power Index 2023 ranking was presented this morning at the Queen Elizabeth II Center in London. The United States, the United Kingdom and Germany lead the top positions in the ranking.

The Global Soft Power Index is the largest and most comprehensive research study on the perceptions of 121 country brands of all the world. With answers collected from more than 100,000 people in more than 100 markets. The Global Soft Power Index 2023 is the fourth edition of this study, which Brand Finance expects to continue conducting annually. In addition to the three key indicators of Familiarity, Reputation and Influence, the Global Soft Power Index also measures the perception of national brands through 35 attributes grouped into 8 pillars of soft power. As a novelty, this year, the ranking includes a new pillar on “Sustainability” due to the importance that decisions in this matter affect the perception of nations. Spain is among the 25 best scored countries (position 24) with a score of 5.7. Germany with 7.4, Canada with 7.0 and the United States with 6.9 lead the ranking in this category.

Pilar Alonso Ulloa, Managing Director Iberia (Spain, Portugal) and South America: “Spain is above the average in Sustainability, highlighting its score in attributes related to sustainable cities and transport. Likewise, Spain is perceived worldwide as an attractive country to invest in renewable energies, as well as in non-polluting technology. Spain’s privileged climatic position makes it a catalyst for investment in green energy”.

The United States of America has once again occupied first place with a score of 74.8 out of 100, followed by the United Kingdom (67.3) and Germany (65.8). There has been little change this year among the 10 global soft power superpowers, with the notable exception of the United Arab Emirates (55.2), which rises to 10th as the first Middle Eastern nation to do so. Further down the ranking, you see much more change and movement.

Among European countries, Spain is the seventh with the best results behind the United Kingdom, Germany, France, Switzerland, Italy and Sweden. Spain has experienced a rise of 1.8 points in the general ranking of soft power, but this year it has dropped one place, from 11th to 12th. His score and position in the influence index have dropped two places, from 11th to 13th, although he increased 0.1 points in Reputation, remaining fifteenth in this pillar.

The pillar with the best results continues to be “Culture and Heritage”, occupying 4th place in the overall ranking, up 2 places in “Great place to visit” and 5 places in “an attractive lifestyle”. She also remains in the top 5 on “Leaders in Sports.” Her ranking and score also went up in the “International Relations” pillar. These are the pillars where she scores best and that generate greater soft power to the nation, attraction to people from other countries and, in the end, increase at an economic level.

In Business and Commerce, it remains in 10th place in “products and brands that make the world fall in love”, but has fallen in “Strong and stable economy”, despite the fact that its score has risen 0.8 points.

The overall score for the Corporate Governance pillar increased thanks to the scores for “Internationally admired leaders” and “Political stable and well governed” although it fell for “High ethical standards and little corruption” and “Security and protection”.

Spain’s score in “Media and Communication” fell, with the sharpest fall in “Issues I Follow Closely”, where it dropped 0.1 points and 10 places. Spain also experienced a drop in “Education and Science” of 0.7 points, and its ranking dropped 2 places to 27th.

In “People and Values”, the second most valued pillar of our nation, Spain fell 0.8 points and 2 places. In general, Spain obtains very good results in this pillar, specifically in “Fun” and “Friendly people” and this year the Spanish are better perceived in the attributes “Generous” and “Tolerant and Inclusive”.

Russia has lost the soft power war with Ukraine

Russia is the only country brand in the world to have lost soft power in the last year, while Ukraine has seen the biggest improvement in soft power, according to the Global Soft Power Index 2023 released today. As Russia’s familiarity and influence have grown due to the impact its decision to go to war has had on lives around the world, the nation’s reputation has been severely damaged. In the study, Russia’s reputation, one of the main determinants of soft power, has fallen from 23rd to 105th, eroding its soft power score by -1.3 points and dropping it from top 10 of the Index to 13th place.

Russia has lost ground relative to other Index countries in all 35 attributes, except for “Issues I Watch Closely”. It now ranks 119th in the “People and Values” pillar and in the “Good relations with other countries” attribute in “International Relations”. In addition, global sanctions have caused the country’s perception of ‘Easy to do business in and with’ to drop 61 places and 74 places in ‘Future Growth Potential’.

David Haigh, Chairman and CEO of Brand Finance, commented: “While nations have turned to soft power to restore trade and tourism after a devastating health crisis, the world order has been upended by the hard power of the Russian invasion of Ukraine. An event difficult to believe if it were not for the intensity of the images that we have been seeing for months and the consequences that the conflict is having both in politics and in the economy.”

At the same time, Ukraine gains +10.1 points (more than any other nation) driven by strong increases in Familiarity and Influence, jumping 14 places to 37th from 51st the year before. Ukraine is now ranked 3rd in the world for “Issuances I Follow Closely” and sees significant increases in attributes emphasized in official communications and media reports, such as “Respect the law and human rights” (up from 69 to 29 ), “Tolerant and inclusive” (up from 63 to 44th) and “Leader in technology and innovation” (up from 26 to 50th). The popularity of Ukraine’s President Volodymyr Zelenskyy, his ministers and advisers sees the nation rise 36 places to 12th in “Internationally Admired Leaders.”

However, many other attributes are negatively affected, from the obvious “Safety and Safety” (down 60 to 118) or “Great Place to Visit” (down 38 to 118), to perceptions of culture and people. Ukrainians, as the focus shifts to their suffering.

The United States is unrivaled as a soft power superpower.

Under the presidency of Joe Biden, United Statesreclaimed the top ranking in last year’s Index and this year has further increased its lead over other country brands. The overall score for the United States has risen 4.1 points, reaching an all-time high of 74.8 points. Thanks to a strengthening dollar and widely publicized large-scale investment projects by the federal government, perceptions of the US economy are on the rise, prompting the US to claim the top spot in “Business and Commerce” from China. . The United States also benefits from the introduction of the new “Invest in Space Exploration” attribute in the Education and Science pillar, where it ranks first in the world. In fact, the United States ranks first in twelve categories and ranks in the top three in four others,

The United States registers stable scores in most categories. However, growing problems with shootings, gun crime and police violence continue to erode the country’s perception as “Safe and Secure” (down from 21st in 2020 to 62nd this year) and its people as ” Friendly” (down from 5th place in 2020 to 103 this year).

The end of the second Elizabethan era

In the UK , 2022 will be remembered as the end of an era. The death of Queen Elizabeth II at the age of 96, after 70 years on the throne, shocked the nation. At the same time, the intense media coverage of the mourning period and the monarch’s spectacular funeral, attended by world leaders, reminded world public opinion of Britain’s greatest soft power assets. The UK has defended its 2nd position in the Index this year, rising 2.4 points to 65.8, registering increases in a range of attributes, from “Good relations with other countries” (up 7 places) to ” Attractive lifestyle” (up 5 places).

Last year will also go down in British history for its three prime ministers. After the fall of Boris Johnson’s government as a result of “Partygate”, Liz Truss rose to power as quickly as she lost it to Rishi Sunak, becoming the shortest-serving prime minister in the country’s history. Although the nation’s overall Reputation has not suffered, the perception of the UK as “Politically stable and well governed” fell relative to other countries (down 10 places).

Post-Merkel Germany resists

Many feared that Germany would lose its international prestige after the departure of Angela Merkel. A year later, the country has largely held its own, retaining the 3rd position in the Index, with an increase of 1.2 points, to 65.8. Olaf Scholz’s government has faced criticism for its faltering response to Russia’s invasion of Ukraine, but this has had little impact on the nation’s perception among the world public. The strength of Germany’s country brand transcends political crises, proving its resilience regardless of who is in charge.

China maintains its “future growth potential” despite COVID-19 restrictions

Although China has experienced marginal growth in its Global Soft Power Index score (0.8 to 65.0), it has slipped in rank from 4th in 2022 to 5th in 2023, behind Japan . While most nations accelerated their global engagement through trade, investment, tourism and talent, China remained in lockdown last year, maintaining a “Zero COVID” policy. The lower mental and physical availability of the China country brand among the global public eroded its ability to improve perceptions at the same rate as competing economies, resulting in some relative declines, such as in the “People and Values” pillars. (from position 57 to 95) and “Media and Communication” (from position 12 to 24).

However, in many metrics, China has broadly defended its position from last year and remains the 2nd country in the world in Influence, behind only the United States, and 3rd in the “Education and Science” pillar, with particularly good results. in “Leader in technology and innovation” (2nd), “Leader in science” (3rd) and the new attribute: “Invest in space exploration” (3rd). The country also maintains its top global ranking for “Ease of Doing Business In and With” and “Future Growth Potential,” underscoring the strength of its business and trade credentials, despite an overall drop in the pillar to third. position. The economic growth forecasts revised by the International Monetary Fund confirm that China has returned to activity in 2023,

UAE enters the Top 10 for the first time

With little change in the top 10, the performance of the United Arab Emirates stands out. For the fourth year in a row, the Emirates had the highest score of any national brand in the Middle East, but this year’s increase from 3.2 to 55.2 has marked a jump of five places, allowing them to claim for the first time the 10th position in the overall ranking. Both the Gulf nation’s Reputation and Influence have experienced notable increases this year.

David Haigh, Chairman and CEO of Brand Finance, commented : “The UAE was one of the first economies to roll out mass and open vaccination during the COVID-19 pandemic, giving it an edge over others and allowed to maintain positive perceptions in the “Business and Commerce” pillar, with a particular improvement in the “Future growth potential” attribute, in which they occupy the 3rd global position. The successful showcase of the Emirates as a world trade center thanks to EXPO 2020 has also undoubtedly provided a significant boost.At the same time, the UAE is one of the largest donors of foreign aid as a percentage of GDP, which is recognized by world public opinion as among the most “Generous” nations. ” of the world, in 3rd position”.

The perception regarding its “Corporate Governance” and “International Relations” of the UAE is also on the rise and the importance of the nation is expected to increase. The Emirates mission to Mars has put the UAE in 8th place in “Space Exploration Investment”, while hosting the world’s most important climate conference, COP 28, will put the nation at the point of look to 2023. The economy, historically based on oil, continues to increase its commitment to diversification, innovation and investment in a more sustainable future. The UAE already scores relatively high on the new pillar of soft power of that name, ranking 19th globally.

Access the full Global Soft Power Index 2023 report here

Access the agenda and the online event here

The Global Soft Power Index is a research study conducted annually by brand evaluation consultancy Brand Finance on a representative sample of more than 100,000 respondents in more than 100 markets around the world, which measures the perceptions of 121 national brands.

Soft power is defined as the ability of a nation to influence the preferences and behaviors of various actors in the international arena (States, corporations, communities, publics, etc.) through attraction or persuasion rather than coercion. . It is deduced from a weighting of the data of the respondents, taking into account the perceptions of the nation brand through the three key performance indicators Familiarity, Reputation and Influence, as well as 35 attributes grouped into 8 Pillars of Soft Power.

The full ranking, methodology, charts, commentary, expert contributions and in-depth interview articles on national brands from around the world are available in the Global Soft Power Index 2023 report.

Access the agenda and live stream of the Global Soft Power Summit 2023 taking place today, Thursday 2 March 2023 at 09:00-17:00 GMT at the Queen Elizabeth II Center in London. The Summit will explore the results of the 2023 Global Soft Power Index and bring together practitioners and researchers to explore and debate the role of soft power in international business and politics.

The Summit will feature a virtual address to the public by the First Lady of Ukraine, Olena Zelenska, and a live virtual discussion with the Minister of Foreign Affairs of Ukraine, Dmytro Kuleba.

The full program of the Summit will include debates on the role of sustainability, media, culture, business, sport and development in promoting soft power, with the participation of, among others, the Secretary of State of Foreign Trade of the UAE, HE Dr. Thani Al Zeyoudi, former Prime Minister of Sweden Fredrik Reinfeldt , Chinese-American environmentalist Peggy Liu, and British broadcaster and columnist Andrew Neil. The day will conclude with a Voice of Australia session in Parliament exploring the impact of colonialism on the current perception of national brands, with the participation of Professor Megan Davis, and featuring a speech by Lord Ed Vaizey on the future of the British Monarchy and the Commonwealth

Situada en una ubicación privilegiada a poca distancia del casco antiguo de Heidelberg, esta moderna casa “Holz100” se encuentra en una parcela boscosa de unos 9.000 metros cuadrados. La propiedad única de bajo consumo energético es especialmente impresionante por su diseño arquitectónico especial y el uso armonioso de materiales naturales como madera, pizarra y piedra de lava. Cinco habitaciones y salas de estudio están alineadas alrededor de una galería grande e inundada de luz con una sala de estar y comedor de planta abierta que cuenta con vistas panorámicas de la ciudad. El jardín natural cuenta con tres terrazas, un sistema de riego automático y una zona de regeneración para la gran piscina orgánica. El inmueble está a la venta con Engel & Völkers por 4,95 millones de euros. (Fuente de la imagen: Engel & Völkers Heidelberg)

Situada en una ubicación privilegiada a poca distancia del casco antiguo de Heidelberg, esta moderna casa “Holz100” se encuentra en una parcela boscosa de unos 9.000 metros cuadrados. La propiedad única de bajo consumo energético es especialmente impresionante por su diseño arquitectónico especial y el uso armonioso de materiales naturales como madera, pizarra y piedra de lava. Cinco habitaciones y salas de estudio están alineadas alrededor de una galería grande e inundada de luz con una sala de estar y comedor de planta abierta que cuenta con vistas panorámicas de la ciudad. El jardín natural cuenta con tres terrazas, un sistema de riego automático y una zona de regeneración para la gran piscina orgánica. El inmueble está a la venta con Engel & Völkers por 4,95 millones de euros. (Fuente de la imagen: Engel & Völkers Heidelberg)